Contents:

When making https://trading-market.org/ decisions based on the average true range, it is important to consider your exit strategy. Many traders use stop loss orders, in particular a trailing stop, as a method to exit a trade if the markets move in an unfavourable direction to their position. However, if the market is moving in your favour, you can modify the exit point, where the trailing stop will follow behind the price to lock in profits. When price movement is in an uptrend and the ATR indicator crosses above the exponential moving average. By understanding the volatility in the market, traders can set definitive price targets and profit objectives.

- It is a stand-alone tool and the first instrument for our trading toolbox.

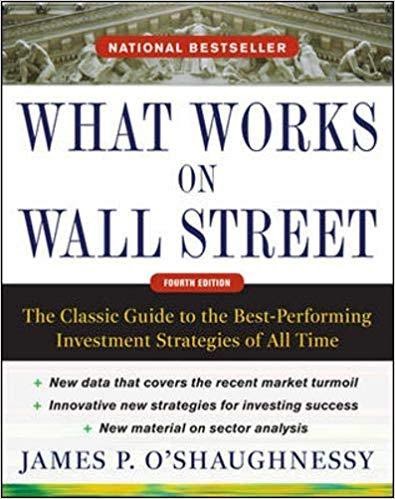

- Welles Wilder Jr. in his book, New Concepts in Technical Trading Systems.

- However, the examples proved that the price could change its direction within a few hours.

Turning off this function by changing the input “SHOW TRADING VOLUME” to “NEVER” will also solve the problem. It is possible to select the currency of your account, making the calculation of trading volume more precise. If you select “COUNTER CURRENCY” then the calculation is made with the account base currency equal to the counter currency of the pair you are trading.

True Range

ATR readings can therefore serve as an indication of the strength or weakness of a trend. Generally, it is recommended to trade high-volatility markets with smaller lot sizes, while larger lots are recommended for low-volatility markets. As shown in the above image, MT4 and MT5 have a default ATR indicator value of 14, which is a helpful starting point for traders. Traders can experiment with different periods to find the exact period that might work best for them. You can estimate the sequential ATR using the previous value of the ATR, combined with the true range for the current period, plus the number of days less one.

Another important aid will be the Economic calendar and financial calendar. Have a try and use ATR on the Tesla chart, for example. Set the position sizing of a trade and open it in one click. If the distance varies from 30% to 70% of the range, take your time.

ATR 3 LWMA – ForexMT4Indicators.com

Stochastic is a technical indicator of the type of oscillator. It’s popular among beginner traders due to its simplicity. Many professionals favor stochastic oscillators because of their signal accuracy and versatile applications. What is the VWAP and how to use it in MT4 and other platforms? Find out the details about this technical indicator as well as strategies for using it on stock, Forex, and other markets. Volatility can start growing, but the indicator’s value will still be low.

A sharp volatility surge is a perfect moment for scalping. You can check my article Forex scalping to learn more about this type of Forex market strategy. The price grows or falls, but the difference between neighboring candles isn’t significant. The current period candle’s highs and lows, and the previous candle’s close. The technical indicator is included by default in many trading platforms and applied as an auxiliary indicator combined with Price Action and oscillators. I’ve been having some success with ranging markets, but needed theory dealing with identifying trends.

www.forexfactory.com

The system allows you to https://forexaggregator.com/ by yourself or copy successful traders from all across the globe. The volume of a position should be determined individually and depends on your goals and deposit. Then switch to the M15 chart and check how many points the price has covered since the daily opening. If the price line went farther than 70%, a reversal is highly likely to happen.

The price has covered nearly 50% of its daily volatility and partly corrected back to the daily range’s start point. If the price line covered less than 30% of the distance, think about opening a trade in the trend direction. The bigger the indicator wave’s amplitude is relative to its previous values, the likelier the price line is to reverse. The longer the period, the more candles are considered, and the smoother the ATR line gets.

As a result, it’s probably not the best time to bet on the continuation of the movement. On the contrary, there may be sensible to look for the signals in the opposite direction. In the chart above, the red level (0.85661) currently represents the daily upper level of the ATR. That other yellow line (0.85350) corresponds to the lower daily ATR level.

The https://forexarena.net/ True Range indicator is used by a lot of professional traders us. They don’t tend to hold trades over the longer term, unless they are part of some type of investment firm. Your typical prop trader or day trader is going to be flat overnight, so they don’t have to worry about positions while sleeping. If that’s going to be the case, then it’s time to bail out of the marketplace.

Then, depending on which zone corresponds to the ATR, the histogram bar is colored by the appropriate color. This way, you can easily recognize how high the ATR (spread/range) is compared to the previous bars. Fibonacci Retracement indicator MA Channels FIBO. Secrets of successful trading with Fibonacci lines. A detailed description of the Fibonacci trading strategy with examples. Market volatility levels concerning specific newsworthy occurrences; what type of news provokes a stronger market reaction. Trailing Stop Loss is a Stop Loss order that follows the price in the direction of a trade and stays at the taken level if the price reverses.

We use the ATR to give us the average number of pips a currency pair has moved in the last specified number of periods. But first, we want to illustrate what parts of the indicator we actually use. Below is a screenshot of what the indicator looks like on the daily time frame. Note that we’ve changed the color of the candles to white to remove any emotional bias so that only the indicator is prominent. Always remember that the ATR movement does not indicate the price direction of the currency pair but the level of volatility in the market. The ATR describes how much an asset typically moves over the course of the day.

How to Day Trade Stocks in February 2023 – Business 2 Community TR

How to Day Trade Stocks in February 2023.

Posted: Fri, 28 Oct 2022 07:00:00 GMT [source]

The ATR Forex market indicator is often considered to be an oscillator as it helps us define new trend reversal points. If the indicator covers over 75% of its average distance in a fixed time period, there can be a reversal. Unlike oscillators, it hasn’t got the “0” and “100” limits that define overbought and oversold territories. Thus, the ATR indicator is a specific technical indicator that combines the three groups’ features. Trading securities on leverage, such as futures, options, foreign exchange and CFDs, carries substantial risk that may not be suitable for every investor. An investor could potentially lose all or more than the initial investment.

No Nonsense ATR is a tool designed to helpNNFX Tradersbacktest strategies and trading in real time. The ATR Channel indicator has slightly more input parameters than the ATR itself. This allows customizing the indicator a little more for own trading scheme. The Colors section in its parameters is responsible for the color scheme and thickness of its lines.

Thus, combining the ATR indicator with other indicators is fundamental to identifying more trading opportunities. Here are the most effective combination strategies for the ATR indicator. Stop loss order should be set at the level of the upper border of the channel. The trade is closed after a bullish candle appears, on which it is already possible to consider opening a trade. The indicator displays the stop levels below the price in a BLUE hue. Forex traders tend to BUY once the indicator changes to BLUE color.